Upswing In Global Climate Bond Investments Tingles Low Carbon Hopes

A recent headline skittered across web pages, as it did above an Environmental Leader article, pointing out a “surprising” upward sign in these tentative times: Along with seasonal temperatures, investor interest in climate bonds has warmed to a tune of $174 billion according to an HSBC Climate Change Centre commissioned research report.

In spite of the financial crisis, institutional investor commitment to action on climate change has grown, not fallen. Climate Bonds, the report author, explains that "what is significant about these findings is that they present a climate-themed bond market that is both broader and deeper than expected” (see the pdf of their study).

Just over two years ago at the 2009 Copenhagen climate summit, already 187 institutions with over USD13 trillion in assets under management (AUM) supported a statement asking for robust policy action. By the time of the 2011 Durban conference assets had increased by 35 percent to over USD20 trn in AUM held by 285 institutions calling for better policy.

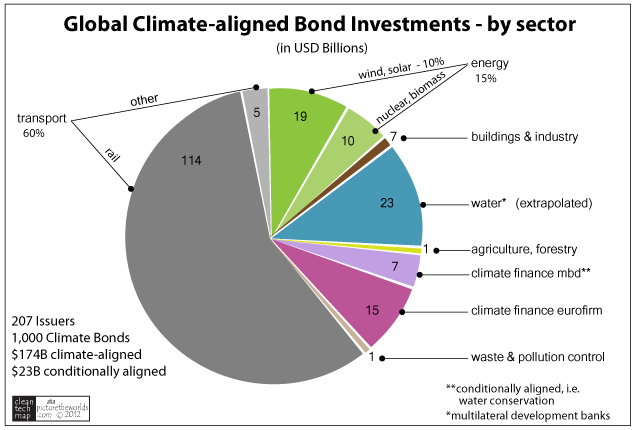

The study identified 1,000 climate-themed bonds from 207 issuers. Such findings could signal the beginning of a transition to a low carbon economy. It set off all kind of tingly ganglions prompting me to extrapolate the findings and turn them into an infographic showing where assets stand today. In addition to the climate-themed bonds, the chart below includes $23 billion in conditionally aligned bonds for water conservation and flood prevention to better visualize the import of global water constraints.

One curiosity is why the 60 percent or $119 billion that went chiefly to rail transport which correlates—albeit indirectly—on fossil fuel for electricity and cargo, is lumped in with wind and solar projects. Notably, these two renewables together claim a 10% share. Add on another 5% of nuclear and biomass projects for a total of $29 billion invested in questionably green but energy-related climate bonds.

Capital for the long-term environmental infrastructure required to build a low-carbon, climate-resilient economy comes with extra upfront investments. This makes bonds well-suited vehicles capable of offsetting initial costs and balancing portfolios. Another advantage climate bonds offer institutional investors is lower operating costs, particularly in the building, energy, industrial and transport sectors—all four being big CO2 emitters and thus perfect opportunity to realize big benefits for investors.

The real point of such a study is that investors seem to be saying that clear policy and market frameworks instead of stop-and-go environmental policy can bolster economies. The larger question is when will government and policy makers learn how to agree that the need to figure out how to get there more quickly is upon us.

You may be wondering how we get there. The study says that to grow this market and lower risk requires clear market norms such as third-party certification and steady policy that will encourage deal flow.

Only bonds issued since 2005 were included as this is the year the Kyoto Protocol came into force and the climate change agenda gained prominence. The ten countries mentioned in the study overview are China, Canada, Russia, Germany, Switzerland, United States, France, United Kingdom, Brazil and Japan.